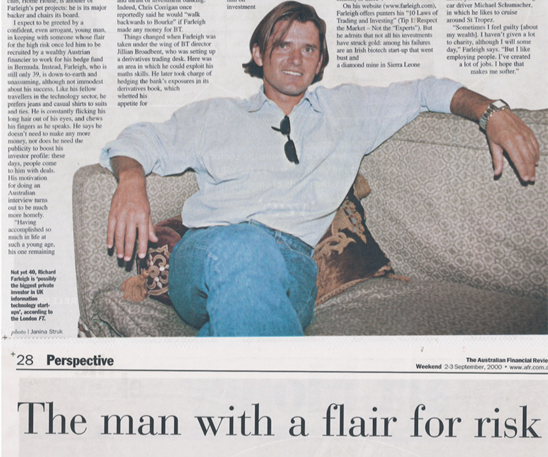

Richard's Story

Entrepreneur, speaker, author

Raised in the Australian care system, Richard Farleigh became a leading investor, entrepreneur, and former BBC Dragon. He has backed over 100 early-stage ventures in technology, hospitality, and innovation, after a career spanning central banking, pioneering derivatives, and managing a top-performing global macro hedge fund. Richard is also an author, keynote speaker, and two-time Chess Olympiad competitor.

From Adversity to

Academic Excellence

Richard was born in Kyabram, Victoria, in 1960 and raised in Peakhurst, a suburb of Sydney, Australia. One of eleven children, he spent months in an orphanage before he entered foster care. These early experiences of hardship shaped his work ethic and gave him a lasting empathy for those starting life with challenges.

Despite a disrupted start, Richard excelled at school, particularly in mathematics and economics. He won a scholarship to study at the University of New South Wales, graduating with first-class honours in economics and econometrics.

Early Career

in Finance

Richard began as an economist and econometrician at the Reserve Bank of Australia, focusing on monetary policy and macroeconomic analysis. His analytical approach and curiosity about global markets led him to Bankers Trust Australia, where he pioneered derivatives strategies and trading algorithms. His results eventually attracted global attention.

Running a

Global Hedge Fund

In the early 1990s, Richard was recruited to run a global macro hedge fund in Bermuda for a European family office. It was here he refined his investing style, blending economics, mathematics, and psychology. By the age of 34, he had achieved financial independence and stepped away from mainstream finance.

Angel Investing

and Innovation

Relocating to Monaco, Richard began investing his own capital into early-stage businesses, particularly in the UK. Over the next two decades, he backed more than 100 ventures in areas such as artificial intelligence, clean energy, life sciences, and hospitality.

He developed a particular interest in companies emerging from university research, offering both capital and guidance to help turn scientific breakthroughs into viable enterprises.

Dragons' Den:

Investing on the Public Stage

In 2006, Richard joined the panel of the BBC's Dragons' Den for its third and fourth seasons. Known for his measured, respectful style, he quickly earned the moniker, Mr. Nice. His investment in Reggae Reggae Sauce became one of the most celebrated moments in the show's history.

Chess, Writing,

and Public Engagement

A keen chess player since adolescence, Richard has represented both Bermuda and Monaco in Chess Olympiads. He sees strong parallels between chess and business - in timing, calculated risk, and strategic foresight.

He is the author of Taming the Lion: 100 Secret Strategies for Investing, a practical guide for navigating markets with logic and discipline, as well as Humble Stumbles, a semi-biographical account of lessons learned in business, and Ricky Means Business, a short novel for teenagers with entrepreneurial themes.

Education,

and Advocacy

Richard served as Chancellor of London South Bank University from 2012 to 2018, championing applied learning and entrepreneurship. In recognition of his contributions, the university awarded him both a doctorate and a fellowship.

Rooted in his own early life experience, he is an advocate for care reform, working to improve opportunities for young people in the care system. He is an ambassador for three children's charities: Action For Children, Their Future Today, and Launch It.

Legacy

and Philosophy

From foster care to financial independence, and from trading floors to television, Richard's journey reflects a combination of strategic thinking, resilience, and a commitment to helping others. Today, he continues to advise, invest, and support founders working on breakthrough innovations.

His story was featured on one of Australia's most-watched documentary series, Australian Story, which you can watch here.